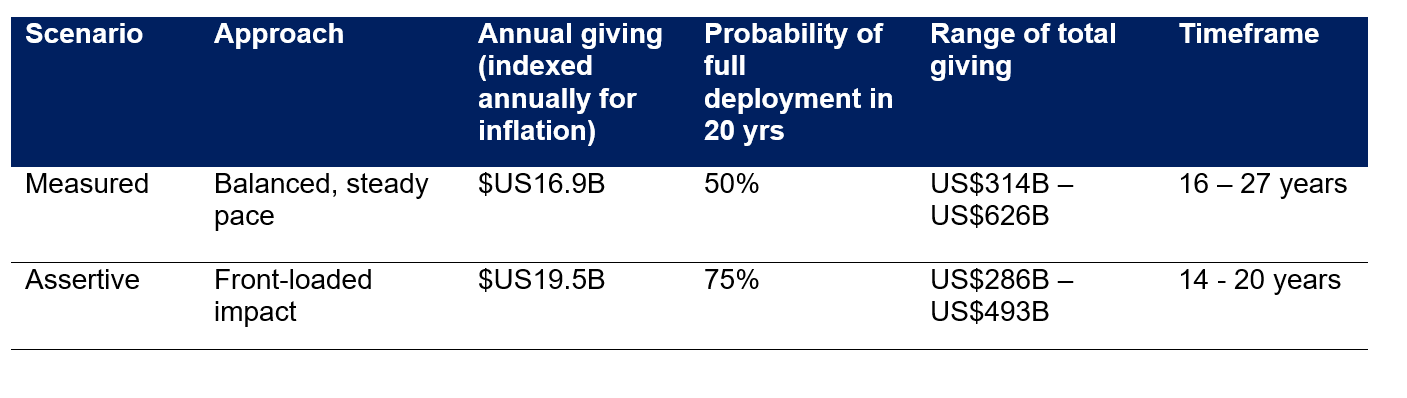

What Bill Gates just taught us about philanthropy: A new playbook for strategic givingBY KEVIN FERNANDO | FRIDAY, 13 JUN 2025 1:26PMWhen Bill Gates announced his intention to give away his entire US$200 billion fortune within the next 20 years, it prompted admiration - but also reflection. For many in the philanthropic and advisory community, it reignited a vital conversation: what does strategic giving look like in a world defined by rising complexity and urgent need? You don't need to be managing billions for this to resonate. Whether you're advising a foundation, guiding a family office, or managing capital for a for-purpose organisation, the question remains the same: how do we give well - and how do we give with intent? Moving from legacy to urgency Historically, philanthropy was structured around permanence. Endowments and foundations were established with the goal of providing a steady stream of funding for generations. However, some philanthropists are shifting away from the idea of giving in perpetuity and towards a "spend-down philanthropy" concept - a model focused on delivering impact on an accelerated timeframe during the donor's lifetime. The key areas of focus are climate change, ecological deterioration and social inequality, to name a few. We've seen a great example of this closer to home. The Yajilarra Trust, established by MYOB co-founder Craig Winkler and his wife Di, was built on the principle of deploying funds in the near term to drive measurable, immediate change. These are not isolated acts of generosity. They represent a new approach - one that values time sensitive impact over tradition and permanence. What a strategic 20-year giving plan might look like for Bill and the Gates Foundation If a philanthropist such as Bill Gates asked for a strategy to fully deploy $200 billion over 20 years, what would the plan look like? Whilst this began as a thought-provoking exercise, it highlights where financial rigour meets purpose. Giving away a fortune isn't just about generosity, it's about aligning desired mission with cashflow planning, strategic asset allocation and risk management. With the aid of JANA's portfolio design modelling, we explored what a strategic 'set and forget' 20-year giving plan could look like for the Gates Foundation. The insights from this exercise offers valuable guidance relevant across a wide range of giving programs. Scenario 1 - A measured pace The foundation could adopt a measured approach, distributing approximately US$16.9 billion per year, indexed annually for inflation. This strategy balances impact with stability, providing a 50% probability that funds are fully deployed within the 20-year horizon. Indicative outcomes reflect, cumulative nominal giving could reach US$421 billion. Depending whether market conditions are less or more favourable, the funds may be exhausted in as little as 16 years, with total giving around US$314 billion, or alternatively could extend over 27 years and reach as much as US$626 billion. Scenario 2 - A front-loaded 'assertive' strategy Taking a more assertive strategy, the foundation increases its annual deployment to approximately US$19.5 billion, indexed annually for inflation. This approach increases the likelihood that the funds are fully deployed within 20 years to 75% and is underpinned by a philosophy of immediacy - recognising that the coming decades may be the most critical window for action. This scenario could deliver US$493 billion in giving over 20 years, but also risks being depleted in an even shorter timeframe under unfavourable market conditions which would result in between US$286-367 billion of spending. These examples are not intended to prescribe a "right" answer. Rather, they highlight the importance of scenario planning and understanding the trade-offs between competing priorities.

Strategic giving demands strategic planning Increasingly, philanthropists, both institutional and individual, are approaching giving with the same clarity and rigour that define other parts of their investment strategy. This is particularly true for purpose-led organisations and their advisers, who must navigate not only the donor's intent but also market dynamics, liquidity requirements, and long-term sustainability. Philanthropy today requires a multidisciplinary approach. It's no longer enough to define a mission; you must also model cashflows, assess investment assumptions, and forecast risk under multiple market conditions. You must ask: what does success look like - not just financially but also in terms of impact - and how do we build the systems to support that vision? Giving is more effective when a donor's intent is guided by a holistic strategy, supported by both qualitative and quantitative analysis. Whether managing a large foundation or starting out as a new donor, aligning financial strategy with personal values requires a thoughtful approach that is both disciplined and adaptable. A new era for giving Against a backdrop of global uncertainty, philanthropic capital has the potential to be transformative - by acting early, embracing risk, and backing ideas that can scale. Bill Gates' decision isn't just a headline-grabbing announcement, it's a signal. It challenges us to rethink the purpose of capital, the meaning of legacy, and the time horizon of impact. For not-for-profits, family foundations, and financial advisers, this is an opportunity to step back and reassess the role of strategy in giving. It's a call to design - not just deliver - philanthropy that's built for the future we want to shape. |

Latest News

Geopolitical risks force family offices into alternatives, cash: Survey

Labor proposes changes to ancillary funds

Australia's billionaire boom branded 'morally wrong' by Oxfam

Ironbark acquires family office firm

Cover Story

Skin in the game

PARTNER, MANAGING DIRECTOR

VIOLA PRIVATE WEALTH